This article is some discussion about AirAsia's reported profit. By pointing out some accounting pitfall in its statements, I hope that this article can present a more accurate picture about the profitability of AirAsia.

Before we start, let's have a glance on the profit reported by AirAsia in recent years:

- FY 2006 (ended June-2006): RM 86.2 million

- FY 2007 (ended June-2007): RM 278.0 million

- 6-month ended December-2007: RM 276.7 million

- 6-month ended June-2008: RM 63.3 million

* (Last year, AirAsia changed its financial year end from June to December.)

All the figure above are PBT (profit before tax). I think PBT is a more accurate measure of AirAsia's profit because its after-tax-profit figures are highly distorted by the "deferred tax" item. (For more about this, please read: My Mistake - the "Defered Tax" in AirAsia's profit )

Nevertheless, there are two things we had to be cautious about these PBT figures.

.

1. Special Income.

First, we should adjust the profit against non-operating income. A significant item in AirAsia's statements is the "foreign exchange gain". As we know, AirAsia has huge amount of loans that is denominated in USD. As a result of USD depreciation in recent years, AirAsia had recorded some "foreign exchange gain". However, most of these "profits" are just accounting gain, which won't generate any real cash flow or economic value.

This is because AirAsia had entered into some foreign exchange forward contracts, which help it to hedge against the appreciation of USD (these contracts had swap the future repayments of AirAsia's loan from USD into Ringgit). So when USD depreciates and the loan amount of AirAsia is decreased, AirAsia should suffer a comparable amount of loss in the value of its hedging contracts. The problem in AirAsia's income statement is, it only regconized the exchange gain from the decreased amount of loan, and doesn't take into account the loss of its foreign exchange contracts (they are "off-balance sheet item" and not reflected on income statement).

Due to some reasons, (e.g. AirAsia is not doing 100% hedge on its loan amount, the fair values of forward contracts also affected by market activities, etc.), the actual gain/loss from foreign exchange rates are more complicated. However, it's quite sure that the real total gain/loss is much smaller than the figures reported in AirAsia's income statement. So, to be conservative, we'd better exclude all the foreign exchange gain/loss to get a clearer picture on AirAsia's profitability.

Besides the foreign exchange gain, AirAsia had also recorded a gain from selling some interest-rate swap contracts during FY2007.

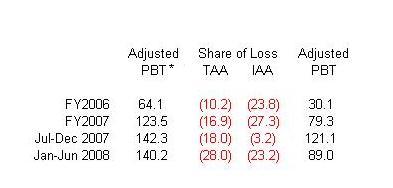

The adjusted profit of AirAsia, excluding those special items, are summarized as follow : (all numbers are RM million)

.

2. The Losses in Thai AirAsia (TAA) and Indonesia AirAsia (IAA).

Until today, TAA and IAA still suffering loss.

AirAsia owns 48.9% stake in TAA and IAA. Thus the same portion of losses from these two entities should be reflected on the income statement of AirAsia. However, AirAsia had stop recognizing these losses from both TAA and IAA.

Again, it's because of the accounting method used.

AirAsia's investments in TAA and IAA are accounted for in its consolidated financial statements using equity method of accounting. The following paragraph is extracted from AirAsia's annual reports:

- The Group discontinued recognition of its share of further losses made by Thai AirAsia as the Groups interest in the jointly controlled entity has been reduced to zero and the Group has not incurred any obligations or guaranteed any obligations in respect of the jointly controlled entity.

Though some people may argue that the equity accounting is a suitable one, I think that the profit/loss of TAA and IAA should be included in AirAsia's statement to fully reflect its profitability.

The reason is simple. First, TAA, IAA and AirAsia are operating as a group (e.g. they share the same ticket booking system), thus they should be considered as parts of a whole body. Second, AirAsia is leasing its aircrafts to TAA and IAA, so they have to pay rental fee and maintenance charge to AirAsia. If their operation continue to face difficulties, it's possible that they will postpone the payments or, worse, fail to meet their payment obligation. Thus, the fact that TAA & IAA are "limited company" doesn't stop AirAsia from bearing the risk of their further losses.

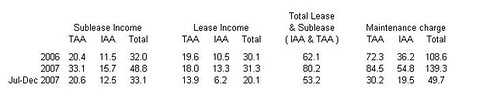

The following tables list the related parties transactions between AirAsia and TAA & IAA, a simple illustration about their relationship.

1. AirAsia's income (RM million) from TAA and IAA:

2. Amount of money that TAA & IAA owe AirAsia (RM million):

.

Conclusion:

To have a fair evaluation on AirAsia's profitability, the non-operating gain/loss should be excluded, and the profi/loss from TAA & IAA should be included. Thus, the real profit of AirAsia in the past few years should be as follow:

(* the first column is the adjusted profit excluding non-operating item).

As we can see, these figures are much smaller than the PBT reported in AirAsia's income statment.

.

...... continue reading : Profit of AirAsia (part 2)

.