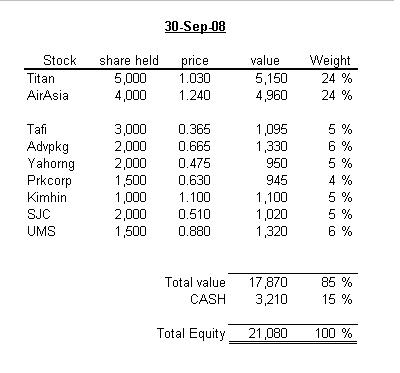

The composition of my portfolio at the end of September is as follow:

I didn't add any money into my account during this quarter. At the end of September, I sold all my holding on Supermx.

I need cash to build my “value-stock portfolio”. Since I don't have extra savings during these months, I'd decided to sell one of my holdings. Compared to the other two companies that I invested (Titan and AirAsia), the management of Supermx is the one that I have least confidence in it. So, it become the first company I decided to sell when I need cash.

Rubber-glove manufacturers are still one of my favorite companies to invest. I’ll come back to them when I have extra cash savings. However, the next time, I think I may be more interested in Kossan instead of Supermx.

My evaluations on the glove manufacturers had changed during this year, mainly influenced by Fisher's writing Common Stock and Uncommon Profit. I had just done my reading on the book few months ago.

.

No comments:

Post a Comment