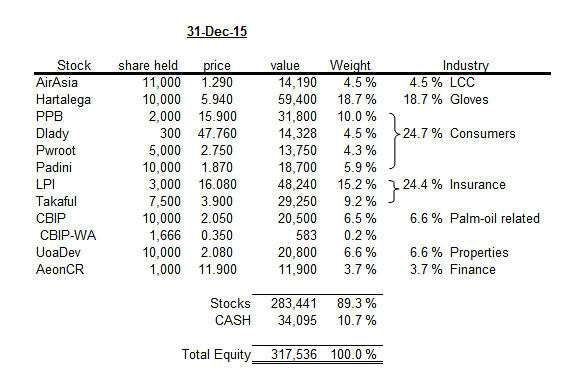

the holdings has little change during the year, just lowering my position on glove companies and invest some portion of fund into Padini.

AirAsia is the main drag factor to the portfolio, its value had been halved during the year. On the other hand, performances of Hartalega, Pwroot and Takaful were well above my expectation.

Investment return of my portfolio during 2015 was about 21.7% p.a., much better than KLCI.

04 January 2016

My Portfolio at the end of 2015

Posted by Unknown at 11:10 PM 1 comments

Labels: portfolio

26 May 2015

Padini Holding Bhd

Bougth 10,000 units of Padini recently at RM1.39 (equivalent to PE ~10 or DY ~7%).

Summary:

x x x

Investment in Padini currently weight ~5% in my portfolio.

Target return rate: 15~20% p.a. (including dividend)

Target holding period: 3 ~ 5years.

.

Summary:

- Revenue and Profit CAGR ~13% during past five years.

- ROAE maintained above 20% for many years.

- high dividend yield.

- net cash position.

x x x

Investment in Padini currently weight ~5% in my portfolio.

Target return rate: 15~20% p.a. (including dividend)

Target holding period: 3 ~ 5years.

.

Posted by Unknown at 5:27 PM 4 comments

Labels: padini

21 May 2015

Lowering Position in Gloves

Sold all my holdings on Supermax, Kossan, and part of Hartalega recently.

Glove-companies are still one of my favorite investment. The main reason of selling is to further diversify my portfolio into other businesses. After this sale, the weight of glove-companies in my portfolio has drop from previously ~25% to about 14% now.

Posted by Unknown at 1:44 PM 2 comments

08 January 2015

My Portfolio at the end of 2014.

The holdings are exactly same as previous year. There's no selling/buying, or any newly-injected fund during the whole year.

The best performers in the portfolio are AirAsia and CBIP, both had been gaining more than 20% in value. While the share prices of Supermx, Pwroot, AeonCr, PPB and DLady had experienced some fall during the year, I believe that their fundamentals are still good, and may perform better in coming years.

The investment return of my portfolio during 2014 was about 1.3% p.a., slightly better than KLCI's performance.

.

Posted by Unknown at 6:22 PM 1 comments

Labels: portfolio

01 January 2014

My Portfolio at the end of 2013.

Activities during the year:

- new fund: RM 72k.

- stocks sold: all the "value-stocks", XDL, Notion, TSH.

- decrease holdings: PwRoot (sold half of it).

- increase holdings: PPB, AirAsia.

- new investment: LPI, Supermx, CBIP, DLady, Takaful, UoaDev, AeonCr.

While the falling share prices of AirAsia and UoaDev were a bit disappointed, the good performances of PwRoot, PPB, TSH, Takaful and LPI were well above my expectation.

The investment return of my portfolio during 2013 was about 33% p.a., much higher than KLCI's performance.

.

Posted by Unknown at 8:24 AM 1 comments

Labels: portfolio

Subscribe to:

Posts (Atom)

SPONSORS: