The main purpose of this article is to discuss why we should examine the economic performance of AirAsia from the perspective of the whole AirAsia Group, i.e. we should consolidate the statements of AirAsia with 100% revenues and profit/losses from TAA & IAA.

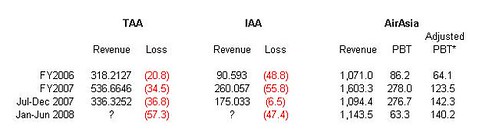

First, let’s have a look at the revenues and profit/losses of the three entities in AirAsia Group, presented separately in the following table (all figures are RM illion):

- (the Jan-Jun 2008 revenues for IAA & TAA are not announced yet.)

- * Adjusted PBT of AirAsia shown excludes non-operating items, but not including the profit/losses from IAA & TAA.

.

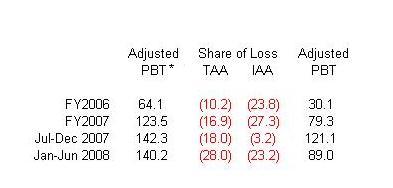

If we include the share of losses (48.9%) from TAA & IAA into AirAsia’s income, then AirAsia’s profit will be as shown in the following table (as discussed in my previous post):

After these adjustments, the earnings of AirAsia will be about 8.9 sen per share (twelve months ended Jun-2008). If we accept this figure, then the current PE ratio of AirAsia is just around 12x, which is a very attractive level for me due to the high potential of AirAsia's earning growth in the coming years.

However, I still think the above adjusted figure is not reflecting the real economic performance of AirAsia. In my opinion, these figures may have been distorted by two factors – the asset allocation in AirAsia Group, and the transactions between the entities in the Group.

Let’s discuss them one by one.

.

1. the asset (aircraft) allocation of AirAsia.

As we know, currently there are two types of aircrafts in AirAsia Group – the old Boeing-737, and the brand new Airbus-320. And we know that the later is the more profitable one due to its oil-efficiency and low maintenance cost. So, the routes served by Airbuses are more profitable than those by Boeing, especially in recent periods of high oil price.

What happening in AirAsia Group is, the allocation of Aircrafts is not even among the entities in the Group. AirAsia Malaysia is operating almost all the Airbuses, while the old Boeings are being pushed to TAA and IAA.

For example, according to the figures announced for the quarter ended Jun-2008, out of the 39 airbuses in the Group:

- 35 of them are allocated to AirAsia Malaysia,

- only five are in TAA,

- and none in IAA.

few weeks ago, AirAsia announced that all its routes in Malaysia are now operated by new Airbuses.

In other words, AirAsia pushed the non-profitable assets to its associates, and retained the most profitable assets within Malaysia. This might be one of the reasons why TAA and IAA are suffering continuous losses while AirAsia is making great profit.

So, if we adjust AirAsia’s income statement using only 48.9% share of losses from TAA and IAA, we are giving more weight on the Airbuses, and have a lower weights on the poor-performing Boeings. As a result, we will get an upward-biased figure about the Group’s performance.

Some people may argue that AirAsia Group is replacing all the Boeings with Airbuses. Thus TAA and IAA might become as profitable as AirAsia (Malaysia) after the replacement. So, the upward biased figures of AirAsia’s statements is a more accurate measure of Group’s future performance (After all, the future performance should be most concern to the shareholders, right?)

I will not agree to this argument. Though AirAsia is accelerating the retirement plan of the Boeings, it will take several years to complete the plan. By then, the new Airbuses today may become aged, and their maintenance will become higher, and who knows, they may just become like the old Boeings today. So, to be consecutives, I think we’d better use today combination of assets (a mix of new and old) even when we are estimating the Group’s future performance.

.

2. The transaction between TAA, IAA and AirAsia. (the Aircraft Rentals)

As we know, all the aircrafts of the Group are owned by AirAsia. So, to operate those aircrafts, TAA and IAA have to pay rental fees to AirAsia. This is another part that may distort the reported performance of AirAsia.

When AirAsia receive rentals from TAA & IAA, it’s recorded as an income, which is off course 100% reflect on AirAsia’s earnings. So, the higher the rental, the more it benefits AirAsia. But from the view of TAA or IAA, these rentals are expenses. That means a higher rental fees will reduce their profit (or increase their losses), i.e. a higher fee will have a negative impact on them and thus AirAsia.

Again, because AirAsia owns 48.9% stake in TAA and IAA, only half of the rental expenses in TAA and IAA would be consolidated into AirAsia’s statement, while 100% of AirAsia’s rental income will be reflected on the same statement. So, by simply charging a higher rental fee, AirAsia could increase its reported earnings without improving its operating performance.

From the perspective of the whole AirAsia Group, the rental fee among entities shouldn’t have any effect on the overall performance. So, we should consolidate 100% of the revenues and profit/losses of TAA & IAA into AirAsia’s statement, to get a clear picture on the Group’s operating performance.

.

Conclusion:

By treating three entities as a group, we can eliminate the potential distortion of AirAsia’s economic performance from both its asset allocation policy and the aircraft rental fees.

The following table shows the 100% consolidated revenue and profit/losses for AirAsia Group. Profit margins of AirAsia (Malaysia only) are included in the table for comparison purpose. (Revenues and PBT are in RM million, Margins are in %).

- The 3rd column (AirAsia Margin) is calculated using PBT reported in AirAsia’s statement.

- The 4th column, Adjusted AirAsia Margin, are reported figures excluding non-operating items (the foreign exchange gain and selling of interest rate swap contracts), and not including profit/losses from TAA and IAA.

- the Group’s PBT and Margin are also excluding non-operating items.

From the table, we can see that the overall profitability of AirAsia Group is much lower than the figures reported in AirAsia’s statement (which only reflect the non-consolidated profit of AirAsia in Malaysia).

.

No comments:

Post a Comment