One of the reasons that investors don't like AirAsia is the huge amount of CAPEX and borrowings.

In this article, I'll discuss how good is AirAsia in managing its debts.

1. Interest rate hedge

Interest rate hike is a essential risk for highly debted company. AirAsia hedges against the risk by entering into interest rate swap contract that will convert almost all of its debt into fixed rate debt.

According to its Dec-2007 report, AirAsia’s swap contract obliges it to pay fixed interest rate of between 4.78% and 4.90% instead of being subjected to the floating US-LIBOR for the entire loan amount over the entire tenor.

The hedging of interest rate will stabilize AirAsia' future cash flow, and help it to maintain the current low interest rate throughout the whole repayment period.

2. Forward foreign exchange hedge

As the borrowings of AirAsia are all in USD, it will benefit from the depreciation of USD. Moreover, Airasia had entered into forward exchange contracts for settlement at fixed Ringgit rates when the USD had depreciated.

For example, as disclosed in Dec-2007 report, AirAsia had swap its RM3.3 billion equivalent debt into ringgit at exchange rates between RM 3.000 ~ RM 3.369. Because the exchange rate of USD to Ringgit is much higher when it borrowed the money, AirAsia is actually making a profit from the repayments of principal loan amount.

These profits from foreign exchange had been recorded in AirAsia’s income statement. In the latest quarterly reports, we can see that the financial cost of AirAsia is a positive value (which means it’s an income, not expenses). This is because the foreign exchange gain from the repayment of debt is higher than the interest expenses.

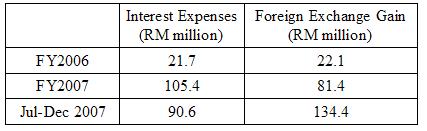

The following table shows AirAsia’s interest expenses & foreign exchange gain during pass two years.

And the most important part is, these exchange profit are recurring! (because AirAsia had swapped its debt into ringgit at a favorable rate.) With this recurring income, I never doubt the ability of AirAsia to pay the interest of its loan.

3. Tax Incentive

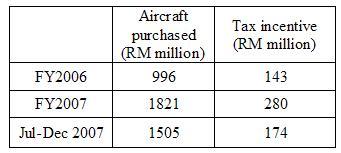

AirAsia has been granted a great amount of tax incentive from our government, for its CAPEX in purchasing aircrafts.

How much is the tax incentive? Let’s look at the recent figures.

From my own estimation, for every dollar AirAsia spent in purchasing aircrafts, the tax incentive incurred is enough for it to pay the loan interest for at least 3 years! As the repayment period of AirAsia’s loans are only 12 years, the tax-incentives had actually helped to cover a substantial part of its financial cost.

So, why not borrowing?

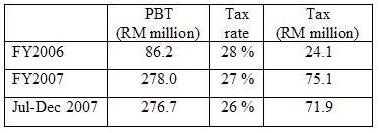

Let’s look at this tax incentive from another angle of view. The following table shows the PBT of AirAsia and the tax it should have paid if there’s no incentive:

And the actual taxes paid by AirAsia during this period are:

- FY2006:RM 2.2 million.

- FY2007:RM 5.1 million

- July-Dec 2007:RM 1.5 million

Can you see how much tax savings had AirAsia been enjoying? This a main reason why I've never worried about the high CAPEX of AirAsia.

In fact, the fast expansion of AirAsia, leveraging on financing facilities, is one of the factors that enable AirAsia to maintain its profitability. Because in the highly competitive LCC industry, only the lowest cost player (through effective cost reduction, economic scale, and fast penetration into the market) will survive and prosper.

Since it's able to manage its debts so well, I think AirAsia's way of expansion (through borrowings instead of issuing new shares) is the best way to benefit the shareholders without diluting our interest in the company.

.

[updated 29-10-2008]: There's a serious mistake in this article -- the foreign exchange gain reported in AirAsia's income statement is not a real gain. Though I don't know the exact figure, I'm quite confident that AirAsia's actual (recurring) exchange gain/losses should be much smaller than the figures stated in this article. For more detail, pls read my post: Profit of AirAsia (part 1).

.

No comments:

Post a Comment