Let's have a quick look on Supermax. With its current share price of about RM2.40,

- the P.E. ratio based on the profit for FY-2006 is about 13.

- the net asset per share is about RM1.20, about half of its share price.

- the liability to equity ratio is about 1.0

As we can see, the figures are not very attractive. Its share price is not at a bargain level, nor is it very expensive. I may consider its current price is quite 'fair' due to its latest financial condition. I invested in Supermax not because of its cheap price. I invest in it because it is a continuous growing company with a bright future.

As Warren Buffette said, "it's much better to own a wonderful company with a fair price, than buying a fair company with wonderful price".

This is what i feel when I invested in companies like AirAsia and Supermax.

Supermax has some criteria that make it a wonderful company that worth to buy:

- Simple business model - manufacturing of rubber gloves

- Growing market for its products

- Good management

- Profitability - Consistent profit margin

Let's go through these one by one:

1. Simple Business Model

Supermax has only one core business – Manufacturing and selling rubber gloves. It has a wide range of rubber gloves, made of natural latex or synthetic rubber. Its products are mainly for dental and medical use. Most of the products are exported, mainly to U.S. and Europe.

The merge between Supermax and Seal Polymer is going to be completed by the end of Sep-2007. Seal Polymer is involved in the similar business as Supermax. I like a company that grow while concentrate on its core business.

2. growing industry.

The demand of rubber gloves has been growing in recent years, due to the growing health conscious and hygiene awareness, especially in the advanced countries like U.S. and Europe's. And the most important point is, the demand on medical gloves will only keep growing, independent of economical cycle. Hence, Supermax has a consistent growing market.

From 2002 until now, Supermax’s revenue and profit had recorded an average growing rate of about 40% per year. I’m confident that its growth rate will be maintained above 20% per annum for few more years.

After merging with Seal Polymer, Supermax now has become one of the biggest manufacturers of rubber gloves in the world.

3. Management Team

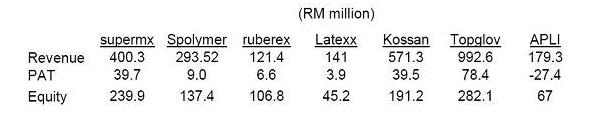

Tthe financial condition of Supermax is better than other glove companies in Malaysia, due to the continuing effort of its management, under the leadership of its CEO, Mr Thai Kim Sim.

Two years ago, Supermax had acquired shares of Seal Polymer and APLI, and became largest shareholder of these companies. Mr Thai had then become new CEO of these companies. At that time, APLI was suffering loss; and Mr Thai had turn APLI into profitable in early 2007. This is an evidence showing his ability of managing a company, especially in reducing operational cost.

about two months ago, most glove manufacturers in Malaysia faced an allegation by Tillotson Corporation (a U.S. company), of patent infringement of nitrile gloves. Supermax then announced that they will pay the loyalty fee to Tillotson Corporation, for all its nitrile gloves selling in U.S. This immediate response shows that Supermax's management is paying respect to intellectual property of other party.

4. Consistent Profitability

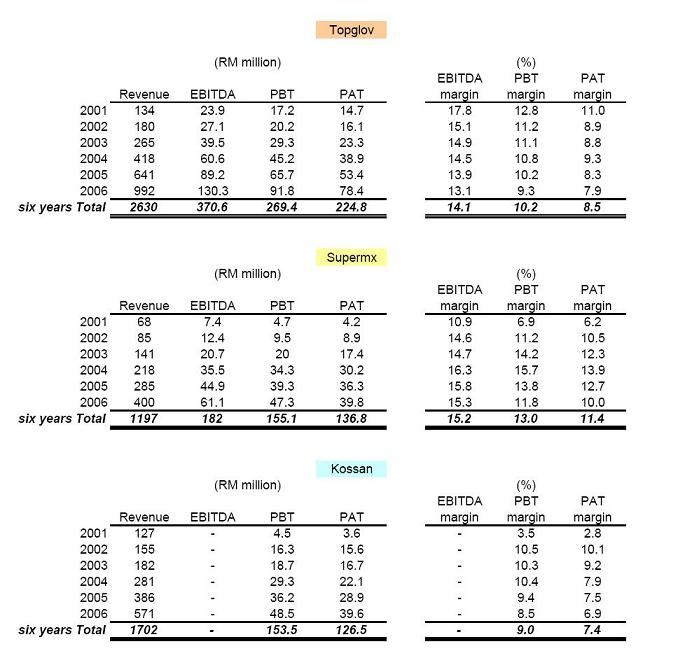

About 50% of its cost is the raw material – latex. In recent years, the price of bulk latex rose from RM2 per kg (year 2002) to about RM5 per kg now. But the EBITDA margin of Supermax is maintain at about 15%. So I never worried about the rising price of latex, because Supermax is always able to pass the rising cost onto its customers.

Besides its consistency, Supermax's profit margin is also better than average value of other glove companies. So, it will always be profitable while selling its product with a competitive price.

.

.

[updated 10/10/2008]: I sold Supermx at the end of September-2008. Please read this post for the reason.

.