[阅读中文版本]

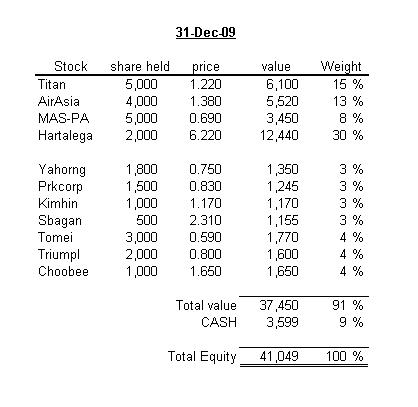

I started this experimental portfolio since 2008 (see here). After two years of practicing, I had done some review and had decided to make some modification on the strategy framework.

.

Entry strategy:

- buy at price lower than 70% of net-working-capital.

a single criterion for stock selection.

This is to make my strategy as simple as possible. In the past two years, I found that it's not hard to find a number of stocks that fulfill this criterion. However, those companies that are suffering lost, or having problem of management's integrity, are definitely out of the list.

Other figures e.g. PE, DY, cash per share, etc. will only be used as supplementary guidelines.

.

Exit strategy:

- sell at price between 80% to 120% of net working capital.

- maximum holding period for each stock is 4 years.

Of course, the ideal exit-price should be above NWC, but I have less confident that every stock in the portfolio will rise above this level. Thus, I need some flexibility.

To determine the suitable selling price (within the 80~120% range), other factors are used as reference, e.g.:

- PE、DY、quality of assets, etc.

- target return rate.

I hope that this strategy can be made more simple in the future.

.

Target return rate:

- for entire portfolio: 25% p.a.

- for each stock in the portfolio: at least 30% p.a.。

Two years ago, I set a 20% p.a. target for the portfolio. That was actually the results achieved by Walter Schloss (who keep practicing net-working-capital strategy) in his 50-year investment lifetime. But recently only I realized that the potential return for this strategy should be higher here, because we have no capital-gain-tax in Malaysia.

Since the portfolio is not always in 100% equity position, and some stock may fail to achieve the target, it's reasonable to have higher target on each single stock than the target of entire portfolio. For those stocks that have good quality, like high DY, low PE, healthy balance sheet, etc., I would aim for a higher target e.g. 60% p.a.

.

Risk Management:

- Weight on each stock shall not exceed 15% of the portfolio value (at the time of purchase).

- Avoid investing in companies of same industry. If there's really a good opportunity, the weight on each industry should not exceed 20% of portfolio.

.

x x x

From now on, all investment decision in my value-stock-portfolio will be made based on this new framework.

.