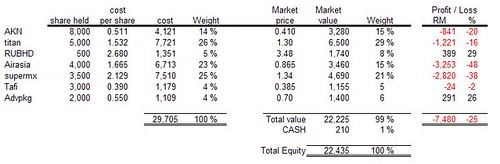

This is the new stock that I’ve added into my “value-stock portfolio”.

I bought it at a price of RM 0.550 two days ago. According to its latest quarterly report (April-2008), its net working capital per share is about RM 1.32, which is more than double of my buying price!

Other criteria found in this stock are:

- Zero debt. (no borrowings)

- Cash per share of about RM 0.65. (at Apr-2008)

- Low PE ratio (about 6, three year average)

- Consistent, uninterupted dividend payment for many years, and net DY > 5% in each of the past ten years (according to my buy price of 55 sen).

I bought the stock just few days after the execution date of its latest dividend (5 sen less 25% tax). So, I didn’t enjoy the latest dividend, and its cash per share should be around 61 sen now. However, my buy-price is still about 10% lower than its cash value.

There are also some negative sides of this stock:

- Its inventories and receivables is very high compare to its PAT. But they are still acceptable if compare to its revenue.

- Its profit margin is very low (about 2% in the past two years), and the margin show a decreasing trend in the past ten years. Some may say that it's in a "sun-set industry".

- The liquidity of its stock (trading volume) is very, very, very low.

The last point is the main reason why I didn’t buy it earlier though I’ve discovered it few months ago -- my quotation just couldn’t be matched.

.