NOTE:

This company was recommended by a member from the forum chinese.cari.com. Then I did some research on it, and surprisingly found that Sungei Bagan is not a plantation company. This article is actually a summary of what I’ve published on that forum. (Those who understand chinese, welcome to pay a visit there.)

Today, I decided to join a forum named The Value Circle. It’s not an open forum, which means only selected members are eligible to view the posts. To join this forum, an analysis article of at least 500 words had to be submitted for approval. As a lazy-man, I just rearranged my opinion about Sungei Bagan into the required format, and translated into English, before doing my submission. I hope that they will approve my application.

I just made a copy of my submitted article here(with little changes). It’s a bit long, enjoy your reading!!!

.

Elevator Pitch:

Most of the people may think Sungei Bagan is a plantation company.

Well, while it’s still running its palm oil business, its investment holding activities has now become the most important parts of this company.

If we have a look at its earning, we’ll find that the operating income from its plantation business is actually quite small, even less than the interest gain from its cash holding. The growth of the company’s equity is now more rely on the dividend income and capital gain from its investment. This capital gain from its investing activities is not stated in the company’s income statement.

From the asset view, the fixed properties only contribute less than 10% of its total assets. More than 50% of its asset is the investment in quote shares, and about 40% is cash.

So, when evaluate this company, we should pay attention to its assets and equity growth.

.

Value Proposition:

In the financial reports on and before FY-2006, the values of Sungei Bagan’s assets are hidden from its balance sheet. This is because most of its investment holding are recorded at cost instead of market value. Starting in FY2007 annual report, the company changed its accounting standard, from then the values of its investment had been reflected on its balance sheet. However, few people noticed about that.

Here’s my summary about Sungei Bagan’s equity.

Fixed Assets.

Sungei Bagan only has two properties.

One of them is the oil-palm estates. According to its report, now Sungei Bagan own 2,744 acres of estate, which is recorded at a book value RM1.36 million. This is surely under-valued, because the last revaluation of this estate was done on 1959. Today, oil-palm estate is worth at least RM 10 thousand per acres, which means the values of Sungei Bagan estate should be more than RM 27 million.

Another asset is a 999-year lease-hold apartment located in London. Sungei Bagan bought this asset in 1997 at a price of RM 7.4 million. Today, it’s recorded at a book value of RM24.5 million. This growth is probably a result of properties bubble. So, for conservative valuation, I think we better revise the value of this apartment back to its buying cost, i.e. RM 7 million.

So, the revised value of Sungei Bagan’s fixed asset should be around RM 35 million. This value show that the fixed assets only made up of about 10% of the company’s equity. ( about 50 sen per share.)

Investment in Quoted Shares

Sungei Bagan has investment in both local and overseas stocks.

In Malaysia, it only invest into two stocks, namely Kuchai and Kluang. Today, Sungei Bagan is 9.38% shareholder of Kuchai, and a 5.98% shareholder of Kluang. The amount of shares held has not been changed for many years. In the FY2007 reports, the market values of these shares is about RM23.3 million.

For the shares outside Malaysia, I’ve no idea about the composition. According to the company’s report, these shares had a market value of RM 91.5 million at Jun-2007.

Sum up the local and overseas holding, the company investment in shares is valued RM 114.7 million.

Investment in Associates

This investment consists of two parts—unquoted shares, and quoted shares.

The book value of unquoted shares is only about RM 6.3 million. So, I think we can ignore this in our analysis.

The quoted shares worth about RM 74.0 million at Jun-2007. This is actually the NAV of its shares in Raffles-Asia Investment Company (RAIC). Sungei Bagan holds about 32% of RAIC, which is actually a closed-end-fund. RAIC is managed by a Singapore’s fund manager, namely Charted Asset Management Pte Ltd. ( website: http://www.cam.com.sg/ )

According to its latest report, RAIC’s portfolio consists of stocks from Singapore, Hongkong, Indonesia, Korea and Malaysia. RAIC declared dividend to its share-holders every year, and most of the time Sungei Bagan would reinvest the dividends into the fund.

Historical Growth of Sungei Bagan’s portfolio.

Sungei Bagan is holding a huge amount of Cash — RM 125 million, equivalent to RM 2.07 per share.

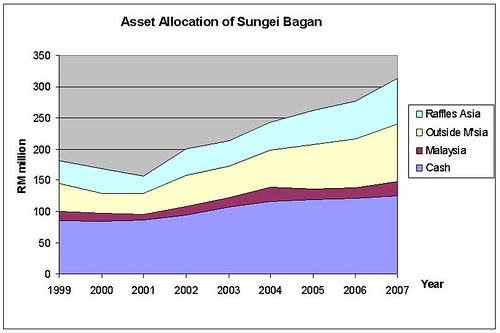

In the following table, I’ve include the amount of cash and the market values of the quoted shares held by Sungei Bagan in the past few years.

(value stated in RM million)

.

The following graph shows the growth of Sungei Bagan's portfolio:

From the table, the value of Sungei Bagan’s portfolio has shown a CAGR of about 7% in these years. The value of this portfolio at Jun-2007 is equivalent to about RM5.20 per share. Now the market price of Sungei Bagan is about RM2.80 per share, which is quite low as compared to its assets.

.

Valuation:

According to the Q2-FY2008 report, the combination of Sbagan’s portfolio at Dec-2007 was as follow: CASH RM 132 million, Quoted Shares RM 107 million, NAV of Raffles Asia (approximate) RM 70 million.

Total value of this portfolio is about RM 309 million.

Due to the current economics climate, many are expecting that the stock market will continue to fall. So, to be conservative, let’s make a 50% discount on the value of quoted shares held by Sungei Bagan. This will reduce its portfolio value from RM 309 million to about RM 220 million, which is equivalent to about RM 3.60 per share.

So, Sungei Bagan’s current share price of RM 2.80 is surely lower than its value.

.

Risk

Because a big part (about 60%) of Sungei Bagan’s portfolio is investment in stock market, its equity will shrink when the stock market is going down. This is the risk that we had to consider.

However, with its current combination of equity, even if the stock market plump 80% from JUN-2007’s level, Sbagan’s portfolio would still worth RM 2.70 per share. If we add in the value of its fixed assets, Sungei Bagan share should worth at least RM 3.0 in this worst scenario.

.

Driver:

If we accept my valuation of RM3.60 per share as the intrinsic value of Sungei Bagan, then the current share price of RM2.80 will give us a safety margin of about 20%. This may not be enough for some conservative investor.

What we can do now is just keep it in the watch list. In my opinion, some event in the near future, e.g. the burst of palm oil price bubble (I believe that it’s just around the corner) would probably give us a best opportunity to buy in Sungei Bagan with a very satisfactory margin of safety.

.

Clonclusion:

Intrinsic value: RM3.60

Classification: Asset Play.

.